Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

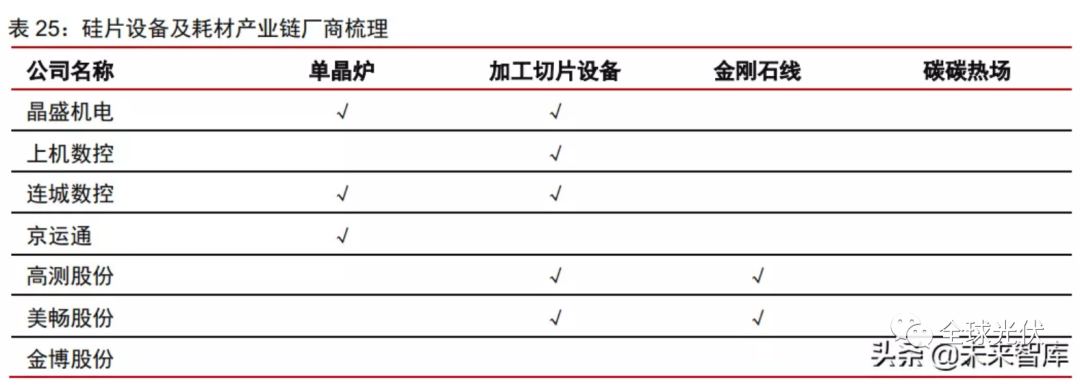

Silicon wafer equipment: Large scale slicing reduces costs, expanding production benefits equipment investment

Monocrystalline silicon wafers are experiencing a peak in production expansion, and it is expected that the corresponding equipment market space will exceed 40 billion yuan by 2022. Based on the overall situation of the industry, it is expected that the investment in single GW equipment will reach about 200 million yuan; Among them, the investment in crystal equipment is about 120 million yuan, the investment in slicing processing equipment is about 50 million yuan, and the investment in automation and testing equipment is about 30 million yuan. According to our tracking of the expansion plan for the monocrystalline silicon wafer industry in the next two years, it is estimated that the market space for monocrystalline silicon wafer equipment will exceed 40 billion yuan by 2022, with corresponding market space for long crystal equipment/slicing processing equipment/automation equipment exceeding 250/100/6 billion yuan, ushering in a peak in demand.

Battery cell equipment: N-type industrialization accelerates, demand is increasing

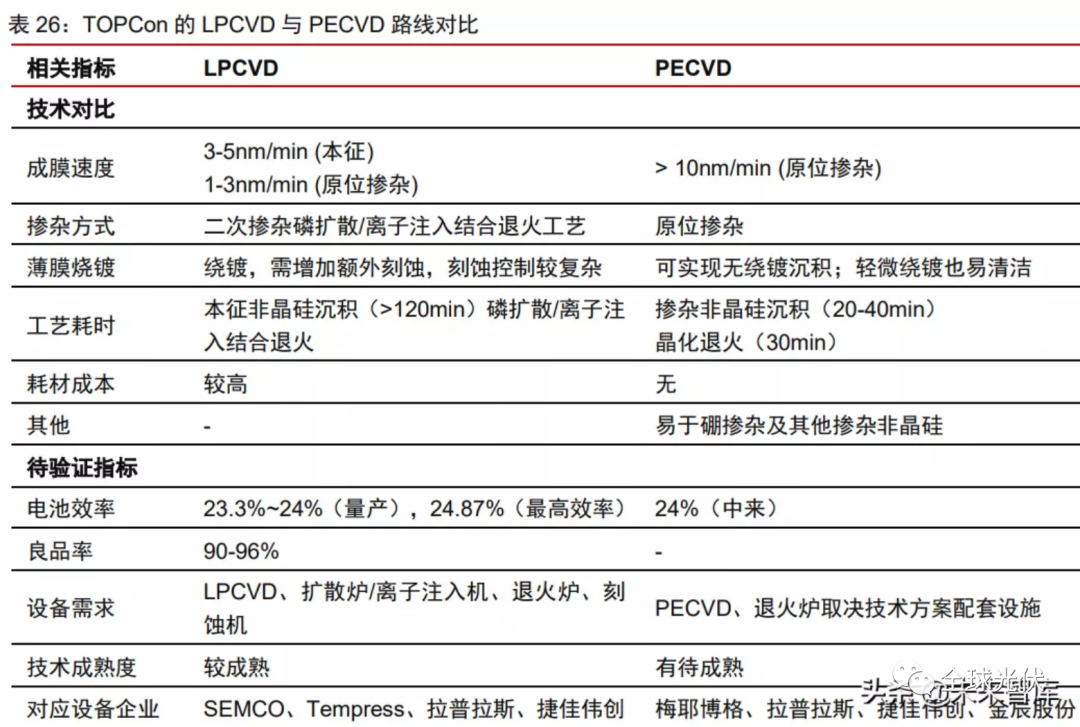

TOPCon is compatible with PERC production line equipment and is the most cost-effective technology route for the next 2-3 years. TOPCon and PERC cell technology have strong compatibility with production line equipment. The main focus is on the renovation of existing equipment in the PERC production line, with the addition of LPCVD/PECVD equipment for amorphous silicon deposition and coating equipment. The PERC production line requires 60-80 million yuan/GW to upgrade to TOPCon production line. The transformation method adopts multiple technological routes, including LPCVD and PECVD, and is divided into three industrial processes:

1) Method 1: Intrinsic phosphorus expansion. LPCVD preparation of polycrystalline silicon film combined with traditional full diffusion process. This process is mature and time-consuming, with high production efficiency, and has achieved large-scale production. However, the biggest problem currently is the slow speed of plating and film formation. This technology is currently the mainstream route for TOPCon manufacturers, mainly including JinkoSolar and Trina Solar;

2) Method 2: Direct doping. LPCVD preparation of polycrystalline silicon film combined with boron expansion and ion implantation of phosphorus process. Ion implantation technology is a single-sided process, and doping ions does not require winding. However, the boron diffusion process is more difficult than the phosphorus diffusion process, requiring more diffusion furnaces and twice the amount of LPCVD. The investment cost is high and the yield is higher, mainly due to the layout of Longi Corporation;

3) Method 3: In situ doping. PECVD preparation of polycrystalline silicon film and in-situ doping process. This method has fast deposition speed, low deposition temperature, and can also be used to prepare polycrystalline silicon layers by PECVD, simplifying many processes and achieving significant cost reduction. The phenomenon of gas rupture has been resolved, but its stability needs to be verified through industrialization. According to Solarzoom, domestic manufacturers such as Laplace, Jiejia Weichuang, and Jinchen Co., Ltd. have already established their presence and are expected to benefit from technological iterations in the future.

HJT equipmentThe acceleration of domestic substitution has significantly benefited leading domestic manufacturers. The production process of HJT has been greatly simplified, consisting of four steps: velvet cleaning, amorphous silicon film deposition, TCO film deposition, and electrode metallization, corresponding to velvet cleaning PECVD、PVD/RPD、 Screen printing/electroplating equipment with four processes. At present, the domestic trial and mass production lines have basically achieved the localization replacement of HJT equipment, especially the four production lines of Tongwei Group's 1GW heterojunction pilot line, which are the "touchstone" of localization equipment. From the current bidding equipment situation of the mass production line, domestic manufacturers such as Jiejia Weichuang, Maiwei Shares, Junshi Energy, and Ideal Wanlihui have basically completed the layout of key equipment and become core equipment suppliers entering the market.

It is expected that the market space for battery cell equipment will be about 45 billion yuan by 2025, with significant growth in HJT and TOPCon equipment. According to the current trend of mature battery cell technology and equipment processes and cost reduction, the unit investment in PERC battery equipment in 2021 is 150 million yuan, and the investment in TOPCon transformation units will increase by about 70 million yuan. The downward space in the next few years is relatively small; At present, HJT equipment has been domestically produced, and it is expected to achieve continuous cost reduction and efficiency improvement in the coming years. It is expected that the single GW cost of HJT core equipment in 2021-2025 will be RMB 4.0/3.5/3.0/2.8/280 million respectively.

According to our forecast data of global photovoltaic installed capacity of 160/210/250/295/350GW from 2021 to 2025, it is expected that the global market space for solar cell equipment will be 181/258/267/351/456 billion yuan from 2021 to 2025, with a CAGR of nearly 20% in the next five years. Among them, it is expected that the HJT equipment market space will be 48/140/180/248/336 billion yuan respectively from 2021 to 2025, and the TOPCon equipment market space will be 13/66/87/103/12 billion yuan respectively. The CAGR in the next 5 years may be close to 90%.

Component equipment: Multi technology driven expansion and upgrading, huge demand space for equipment updates

The process flow of component equipment is relatively long, and the value of string welding and laminating equipment is the highest. The process chain of the components is relatively long, mainly divided into battery sorting, laser cutting for battery selection and segmentation, and then connected to the busbar through single welding and series welding links to form battery string components. Furthermore, the back plate, glass EVA、 The placement and laying of battery cells are carried out, and then laminated and fixed. Finally, steps such as edge cutting, testing, framing, junction box installation, and cleaning and testing are performed. Each stage requires corresponding component equipment, and the string welding and laminating technologies have the highest content and relatively high equipment cost proportion, accounting for 33%/13% of the component stage equipment cost.

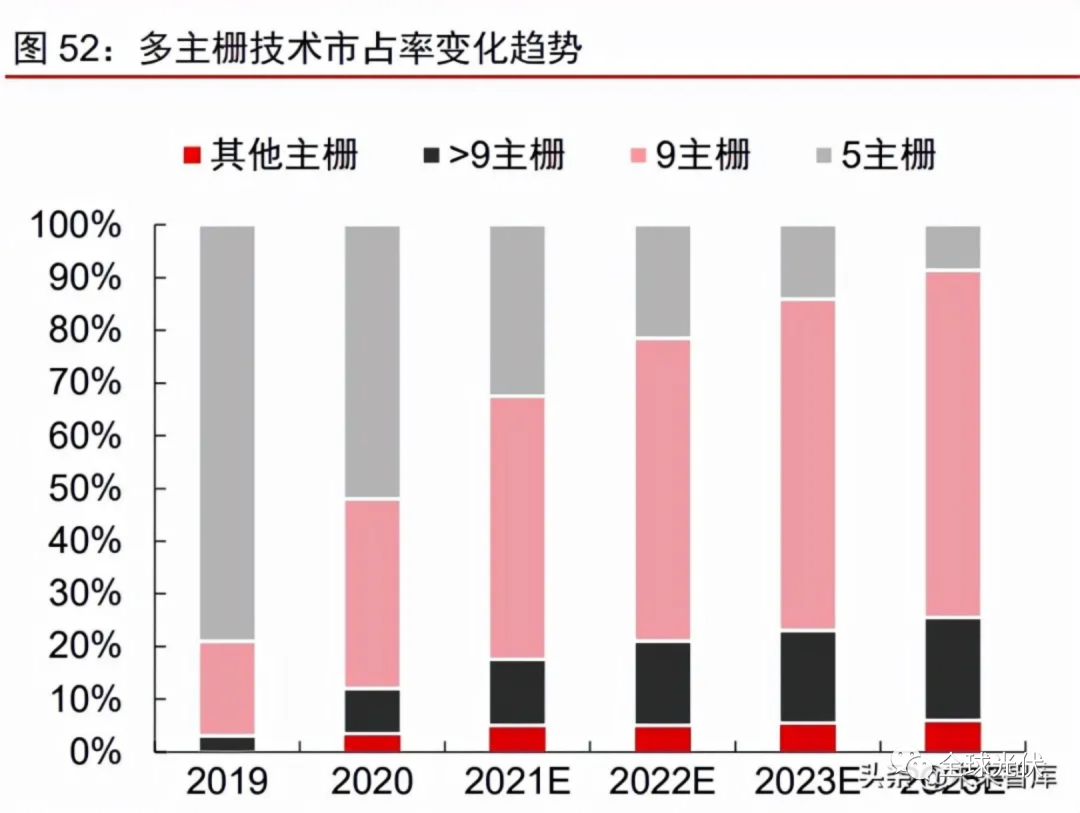

MBB technology increases efficiency and reduces costs, driving the demand for multi main grid series welding machines to be released. MBB technology, also known as multi main gate series welding technology, has three major advantages: increased power, reduced cost, and improved reliability. 1) The multi main gate technology increases the number of main gates, improves the amount of light received by the battery, shortens the current transmission distance of the thin gate line, and reduces the series resistance loss, which can increase the power of the crystalline silicon component by about 5W compared to 5 main gates; 2) It can offset the increase in welding tape and EVA costs, reducing silver paste consumption by more than 30% from 5BB to 12BB, thereby reducing battery costs; 3) In terms of reliability improvement, multiple main gates have stronger resistance to hidden cracks due to the increased number of main gates, resulting in a much lower efficiency decrease compared to components with 5BB and below. In 2020, the market share of multi main gate components was 66%, and CPIA expects it to increase to 75%/85%/95% by 2021-2023. With the development of multi grid technology, strong compatibility is required for string welding machines, driving the rapid growth of multi grid string welding equipment.

Half cell/multi cell batteries will become mainstream products, and the demand for string welding machines will double. Due to the use of a "series parallel" mode in the half cell battery, the voltage remains unchanged, but the resistance is only one fourth of the original. Half piece components have the following three major advantages:

1) Reduce packaging power loss. The packaging loss of a half cell battery is only 0.2%, while the packaging loss of a whole cell battery is about 1%;

2) Reduce shadow occlusion loss. The number of half cell battery strings has doubled, and more battery strings provide better battery tolerance;

3) The internal current and losses of a half cell battery are reduced. Half cell reduces internal power loss, and the overall low operating temperature of the half cell improves the photoelectric conversion rate of the component. Due to the doubling of processing actions, the demand for string welding capacity for half cell batteries has doubled, and the demand for string welding machines for three cell batteries has tripled. Therefore, in the future, the demand for string welding machines and cutting machines driven by half cells (or a few tenths of cells) will double.

It is expected that the market space for component equipment will reach 25.7 billion yuan by 2025, with a CAGR of approximately 43% over the next five years. Under the premise of technology driven cost reduction in the photovoltaic industry for a long time, the development of processes such as large silicon wafers, thin films, battery half cells, and multiple main gates will bring rapid technological iteration and updates to component equipment, and component equipment will continue to see a continuous increase in volume. In the component stage, the investment for a single GW equipment is 60 million yuan, of which the value of each stage's equipment is 3 million yuan/GW for the cutting machine, 21 million yuan/GW for the string welding machine, and 8 million yuan/GW for the laminating machine. According to our forecast data of global photovoltaic installed capacity of 160/210/250/295/350GW from 2021 to 2025, the global module equipment market space is expected to be 94/128/163/208/258 billion yuan from 2021 to 2025. Among them, the market space for core equipment string welding machines from 2021 to 2025 is 35/47/60/77/96 billion yuan, with a CAGR of about 43% in the next five years.

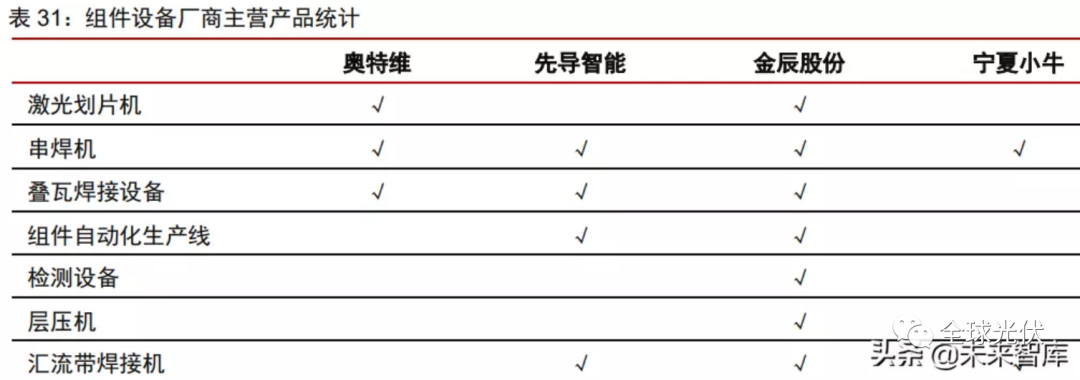

The market pattern of component equipment continues to optimize, and the market share of leading enterprises is further expanding. The main equipment for photovoltaic modules includes laser cutting machines, string welding machines, busbar welding machines, laminating machines, and automated production lines. From the current market competition pattern, there are four leading component equipment manufacturers, and the market concentration is continuously increasing. Among them, Aotewei can provide component production equipment mainly consisting of string welding machines and laser cutting machines, while Pioneer Intelligence is committed to providing string welding machines, tile stacking welding equipment, and automated production lines. Ningxia Xiaoniu mainly produces string welding machines.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2